Is It Wise to Upgrade Your Home Before You Sell It?

One of the biggest questions many homeowners have is: Should you upgrade your home before you sell it? Is the investment going to pay for itself? Should you make specific decisions about your home that a future buyer may or may not be happy with? There are arguments for and against making lots of upgrades. A decent Realtor can help their seller research how much various upgrades may cost, and what might give them the most bang for their buck.

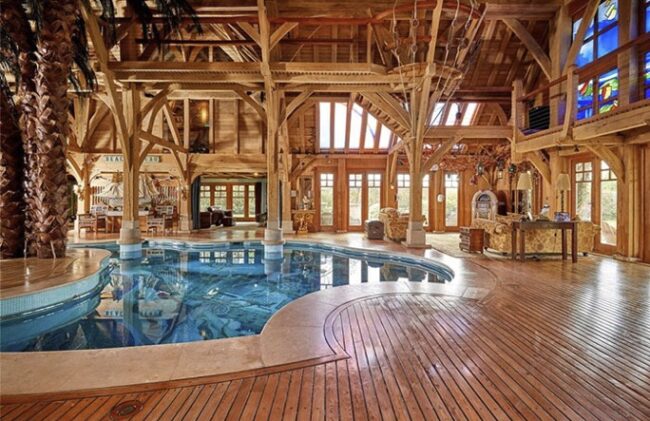

Most people start their home search online. So, the photos for a home are in most cases the first impression that a potential buyer gets of a house. And as many people say, you never get a second chance for a first impression. Most Realtors will try to get their seller to at least get the house de-cluttered, vacant or just as clean as possible for photos. If it’s in the seller’s budget, do we want to replace appliances? Do we want to put in granite or quartz countertops? Does the bathroom need an updated vanity? What kind of lights and ceiling fans do we have? Obviously, it comes down to budget. And each seller will have a different circumstance.

For many people, hardwood floors are much preferable to carpet. In some cases, just putting in new carpet can be a great upgrade. But if you can afford it, putting in hardwood floors, or luxury vinyl plank flooring can be a nice upgrade.

At Gay Realty Watch, we look for news to share with you about the gay real estate market – both lgbt real estate news and news specific to gay and lesbian real estate meccas.

Authored By Joseph Hudson

See the Full Story at the Washington Blade